When a return is calculated, input data from worksheets populate the applicable government forms with the calculated data.

Do the following to calculate a return:

- Open or create a return.

- Enter all mandatory data.

- Click Calc in the Process group on the Home tab to calculate the entire return, or click the down arrow below Calc and select from one of the following additional options:

- Recalc. Calculate the return, regardless if a change has been made to the return data. If you are aware of changes that were saved to a return configuration set while working in a return that is associated with the return configuration set, you must reopen and recalculate the return to apply the changes.

- Federal Only. Calculate only the federal return and no state information.

- Return Group. Calculate subsidiary returns in a consolidated group. If you calculate the consolidating return, all subsidiary returns requiring calculation will be calculated before the consolidated return.

- If returns in the group are locked, in-use, or deleted, a list of those returns displays.

- If any of the returns in the consolidated group are password-protected, you must enter the password before calculating.

The system calculates the return and updates the return's processed history.

If the User Options > Tax > Miscellaneous option Display calc complete confirmation message after each calculation is selected, the system displays a message when calculation is complete.

Return Balance Due or Refund Display

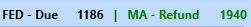

After each calculation, the return's balance due or refund amounts are refreshed for the federal and home state units on the right side of the tax return window above the ribbon. This provides the monetary obligation or benefit for the return without having to navigate to worksheets or government forms.

After entering new input, the amounts display in gray text, alerting you to calculate the return to display the current amounts in green (refund due) or black (balance due) text.

Calculating Large Returns

Calculation of large returns can take an extended amount time and are sent from Tax to Batch Manager for processing. You can continue working on other returns while calculation completes.

Tax provides you the following options:

- Calculate return. Sends the return to Batch Manager as a Large Calc job type.

- Calculate and print to PDF. Sends the return to Batch Manager as Large Calc and Print Large Return job types.

The return is locked until your selected option completes.

The following can qualify as a large return:

- All return types. A large number of depreciable assets with one or more states.

- 1065, 1041, and 1120S. A large number of partners (1065 K-1’s), beneficiaries (1041 K-1’s), shareholders (1120S K-1’s) with a significant amount of activity numbers for rentals, farms, trade / business, passthroughs, or multiple states.

- 1065. A large number of partners (K-1’s) and depletion properties.

- 1120, 1120S, and 1065. A consolidated return with many subsidiaries.

- 1065, 1120, and 1120S. Any of the above situations with the State and city tax accrual option selected on the Return Options > Calculation Options worksheet.

Deducting Authorizations

If your firm is licensed to deduct authorizations on a Pay-As-You-Process (PAYP) basis, applicable federal, state, or consolidated authorizations are deducted when returns are calculated or printed if they have not been previously authorized. Authorizations are also deducted when the Social Security Number or Employee Identification Number is changed or tax authorities are added after the return was last authorized. For group calculations, the system first displays the number of authorizations needed for all returns and identifies the entities that are contained in the returns in the return group.